3. Charging The Customer

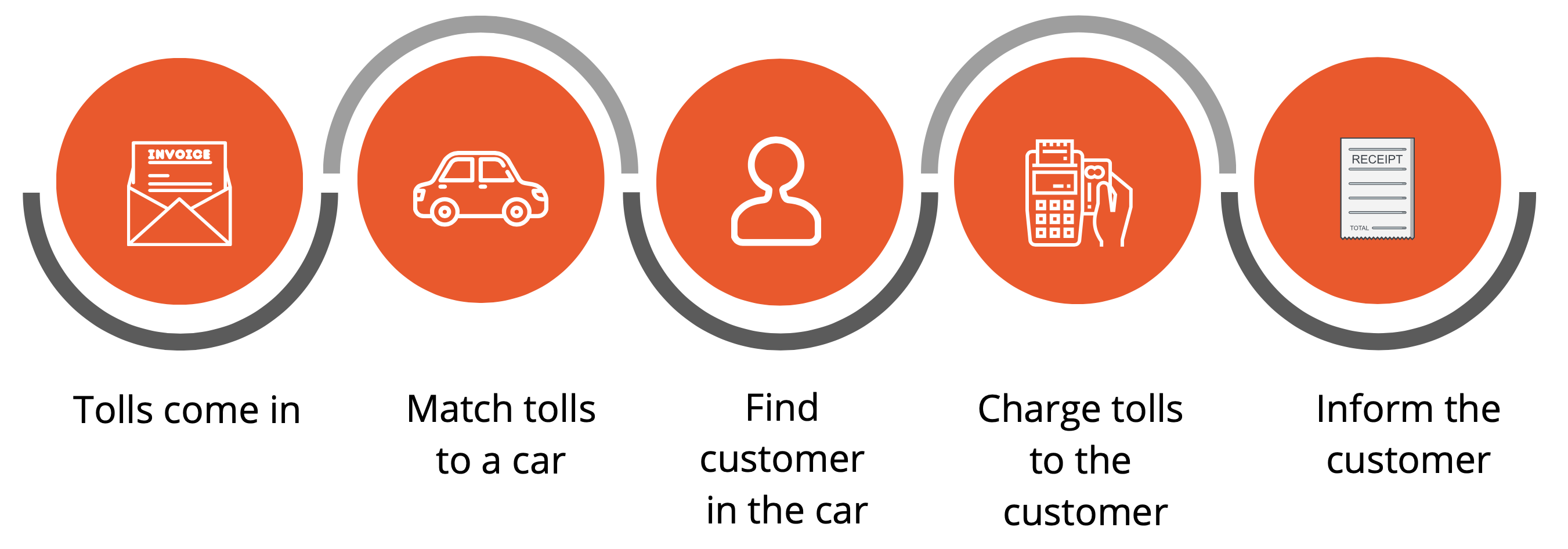

After registering your vehicles, you can begin the daily or weekly task of calculating charges.

Toll agencies provide the option to download toll transactions from their online portal, which can be matched to a loaner contract. The amount of information provided by toll agencies varies, with some listing license plates and transponders, while others only list license plates or transponders. To ensure accurate tracking and avoid corrections, it's crucial to maintain accurate records of the relationship between license plates, transponder numbers, loaner numbers, and VIN numbers.

After tallying all tolls, it's time to charge the customer. To collect payment, it's best to obtain the customer's credit card at checkout and inform them that their payment method on file will be used to charge for tolls later on. Make sure to use a PCI DSS compliant solution to securely save credit card details.

Once payment is collected, it's beneficial to provide the customer with a detailed breakdown of the toll charges, in case they have any questions or concerns.